Welcome to the ever-evolving world of finance, where dynamic and vast landscapes shape the very foundations of businesses. Among the concepts that define financial success, one term stands out and commands the utmost attention – the ‘Working Capital Cycle.’ This essential component serves as the lifeblood that sustains businesses, ensuring their survival and growth.

In the world of business, adaptability and brainstorming are essential for navigating the ever-changing market. As entrepreneurs, executives and financial enthusiasts, we must embrace thrive these qualities amidst challenges and seize opportunities.

In this article, we’ll dwell on the depths of the working capital cycle and find out its significance in the web of finance. Let’s discover the strategies and best practices that empower businesses to optimise their operations, streamline cashflows and achieve sustainable success.

What is Working Capital?

As we understand, a company’s working capital, sometimes referred to as net working capital (NWC), is the difference between its current assets, such as cash, account receivables, unpaid invoices, or inventory, and its current liabilities, such as accounts payable, or unpaid invoices from vendors or sellers, and debts. It’s a frequently employed metric to evaluate the current health of an organization.

Working capital, or net working capital (NWC), is the difference between a company’s Current Assets (Like cash, accounts receivable financing i.e., unpaid customer invoices, and inventory) and its Current Liabilities (such as unpaid vendor invoices and debts). This widely used metric serves as an indicator of an organization’s short-term financial well-being.

Current assets are all assets that a company anticipates turning into cash in the next year. It is frequently used to assess a company’s liability.

Financial liabilities of a company organization that are due and payable within a year are known as current liabilities. When a business engages in a transaction that raises the possibility of a future overflow of money or other resources, such a transaction creates a liability.

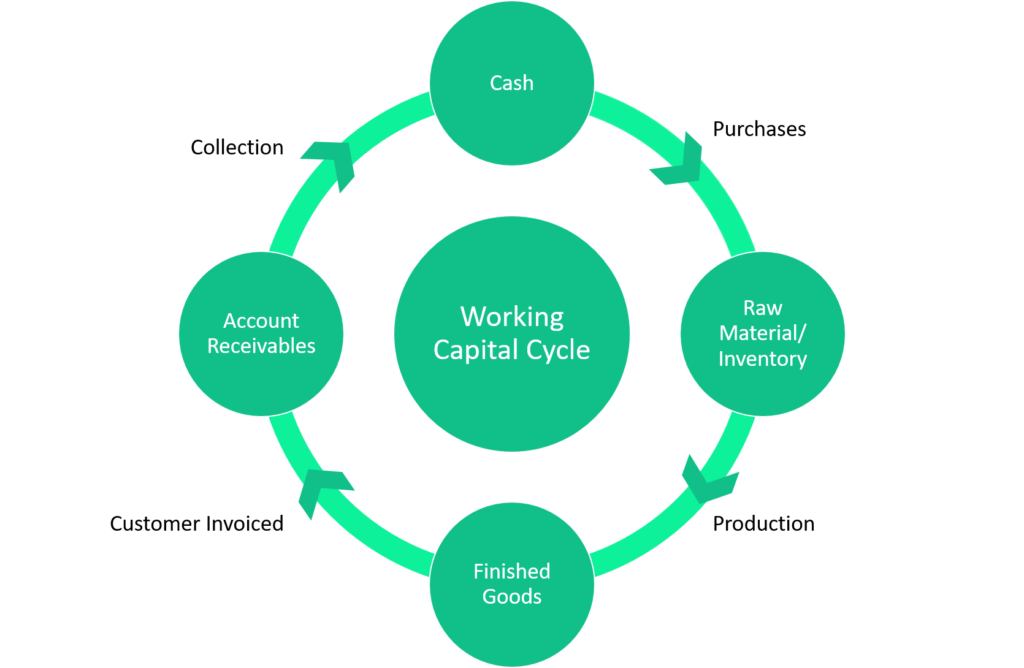

What is Working Capital Cycle?

Working capital cycle is the ammount of time it takes to convert total current assets without current liabilities (Net Working Capital) into cash. Businesses usually manage WCC by selling inventory, collecting revenue from customers, and paying bills slowly for optimizing cash flow.

Why is working capital so important for all businesses?

Working capital cycle is important for businesses due to several compelling reasons:

Enhances solvency: It helps the business handle short-term expenses like buying materials, paying salaries, and covering other intermediate costs. This is crucial because some of these expenses can’t be delayed and having money on hand ensures that the business can keep running smoothly.

Increased goodwill: Working capital creates a positive image for the business. When the company can pay its bills and employees on time, it earns a good reputation with its staff and also with suppliers and distributors.

Uninterrupted supply of raw materials: Having sufficient working capital allows for the timely payment of suppliers, ensuring a consistent flow of raw materials. On the other hand, if a business faces difficulties in paying its suppliers promptly, it can lead to a halt in production.

Improved ability to face any crisis: In addition to maintaining the smooth functioning of business operations, working capital enhances a company’s ability to handle financial crises effectively. A business with enough liquidity can better safeguard itself against unexpected situations. Therefore, how a business finances its working capital is vital for its financial health and its ability to operate smoothly in different situations.

Challenges encountered by MSMEs concerning WC:

Even though MSME contributes significantly to the Indian economy, these firms nevertheless have trouble getting access to working finance.

According to a recent analysis by RBI, the introduction of the goods and service tax (GST) and demonetisation were the two huge shocks to the MSME sector. Due to the majority of MSMEs being included in the tax net, the implementation of the GST resulted in a rise in compliance costs and other operating expenditures. However, because of its size and kind of business, the MSME sector has operational issues and is consequently substantially more vulnerable to economic shocks.

The challenge faced by micro and small enterprises in the county is partly attributed to their creditworthiness. They find it challenging to accept financial aid from commercial banks and financial institutions because of their weak economic foundation. They are typically compensated last in the value chain.

Due to the fact that their reserve has been fully invested, MSMEs have no legal recourse for collecting debts. Because the statutory dues are still unpaid, they rely on the working capital for any additional expenses, which can potentially result in improper balance sheet management. The CIBIL score of the business may be impacted.

Working Capital Cycle Formula

The amount of time it takes for a business to turn its whole net working capital- current assets minus current liabilities- into cash is known as the Woking Capital Cycle.

Inventory Days + Receivable Days – Payable Days is the formula for the WCC.

For e.g., If Inventory days = 80, Receivable days = 30, and Payable days = 90.

Then, the Working Capital Cycle shall be 80 + 30 – 90 = 20.

Accordingly, the business only has to pay out of pocket for 20 days.

Steps Involved In Working Capital Cycle

The Working capital cycle typically involves the following steps for most of the businesses:

- The businesses buy necessary supplies for manufacturing products on credit. For instance, they are given a period of 90 days (referred to as payable days) to settle the payment for the raw materials.

- On average, the company completes the sale of its inventory in 85 days (Inventory days).

- Consumers frequently settle payments for their purchases with the business within a period of 20 days (receivable days).

During the initial phase of the process, the company acquires the necessary materials to generate inventory without an immediate cash outlay. This acquisition is done on credit and falls under the category of accounts payable. After a span of 90 days, the company becomes obligated to make the payment for these acquired materials.

After a duration of eighty-five (85) days from the material purchase, the finalized products are manufactured and sold. However, the company doesn’t receive instant cash for these transactions, as they occur on a credit basis (recorded within accounts receivable). Subsequently, about twenty (20) days following the product sales, the company attains the cash receipts, thereby concluding the working capital cycle.

What Does “Positive WCC” Mean, and On What Does It Depend?

If a company has a substantial positive NWC, it might be able to invest in growth and expansion. A company has been said to have low liquidity if current assets do not equal its current liabilities, which could make it difficult for it to pay its debts and creditors as they become due.

The amount of working capital a company has typically depends on the industry it falls under.

Some industries with longer production cycles may have greater working capital requirements because they don’t have the quick inventory turnover needed to produce cash on demand. In contrast, retail businesses that deal with thousands of consumers every day may frequently raise short-term financing considerably more quickly and have fewer working capital needs.

Phases of Working Capital Cycle

Businesses generally control their performance levers, Inventory Turnover, Sales Collection efficiency, and Seeking/demanding credit for purchases, for the efficient administration of Working Capital/Cash Flows.

To maximise cash flow, businesses often aim to control this cycle by selling inventory quickly, collecting money from buyers quickly, and delaying payment to vendors and sellers for procurement.

As we understand, the Supply Chain is an ecosystem of individuals and companies who are involved in creating a product or rendering a service and delivering it to the consumer. The producers of the raw materials are the first links for a manufacturer, and the chain is completed when the finished products are delivered to the final customer.

The working capital cycle is a crucial process because a supply chain that is streamlined reduces costs and improves the productivity of the production cycle. Businesses aim to shorten their working capital cycle to cut expenses and maintain their competitiveness.

Working capital finance, such as Factoring, Invoice Discounting, or Sales Invoice Discounting as available on the M1xchange TReDS platform. It is a crucial component of supply chain management because it lowers financing costs and increases business efficiency for buyers and sellers involved in sales transactions.

M1xchange TReDS platform is one of India’s Top Platforms for working capital finance and working capital optimisation. TReDS has shown to be one of the best methods for financing working capital for MSMEs. TReDS provides working capital finance to MSMEs to enhance the supply chain.

FAQs

Cash and cash equivalents, Accounts receivable (AR), Inventory, and Accounts payable (AP) are the four primary elements of the Working Capital Cycle.

The time it takes to sell inventory and receive payments are two crucial factors that affect most of the business’s working capital cycle.

Manage the working capital cycle through strategies like minimizing inventory, efficient vendor payments, debtor management, electronic systems for transactions, and securing suitable financing.

Working capital cycle ratios are financial metrics that assess how efficiently and effectively a company manages its working capital.

Working capital reflects company’s liquidity and the ability to meet short-term obligations, while the working capital cycle signifies the time needed to convert current assets into cash.

Yes, a high working capital cycle allows more time for favourable cash flow generation, often prompting businesses to expedite inventory turnover, speed up payment collection, and delay bill payments.

Factors such as prolonged asset-to-cash conversion time, high inventory, seasonal demand shifts, and lengthy production processes contribute to an increased working capital cycle.