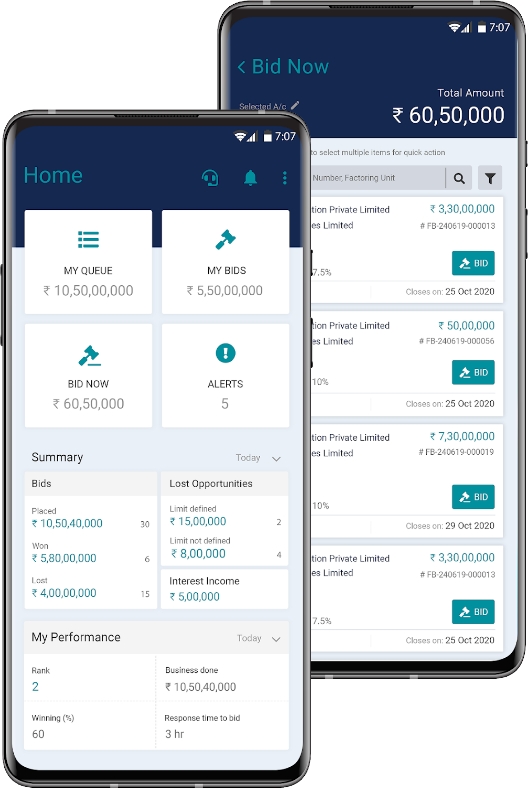

In Infra industry, working capital efficiency is paramount. M1xchange’s TReDS platform has been a game-changer for us, driving timely & hasslefree payment to MSME Suppliers.Thanks to reduced working capital gaps, collateral-free limits, reduction in interest cost and digital transactions, M1xchange is now becoming an essential part of our journey to success.