Bill Discounting is a short-term financing solution that allows businesses to convert their unpaid invoices into immediate working capital. In this process, a supplier sells their invoice or bill raised against a buyer to a financier (such as a bank or NBFC) at a discounted value before the payment due date. The financier pays the supplier upfront, and in return, collects the invoice amount from the buyer on the due date. This mechanism improves cash flow, reduces working capital cycles, and supports uninterrupted business operations.

M1xchange Bill Discounting offers this solution digitally through the TReDS platform, an RBI-licensed digital marketplace that facilitates transparent and secure invoice discounting for MSMEs, large corporates, and financiers. TReDS (Trade Receivables Discounting System) enables MSMEs to access timely funds without pledging collateral, helping them meet operational needs and scale faster.

On the M1xchange TReDS Platform, bill discounting is executed in a seamless and paperless manner, where buyers, sellers, and financiers interact on a single platform. With RBI regulated guidelines and competitive bidding, MSMEs get the best possible financing terms, while buyers and financiers benefit from improved vendor relationships and credit assessment data.

Bill Discounting on M1xchange is a key enabler of liquidity and financial inclusion across supply chains, especially for MSMEs operating in India’s diverse economic landscape.

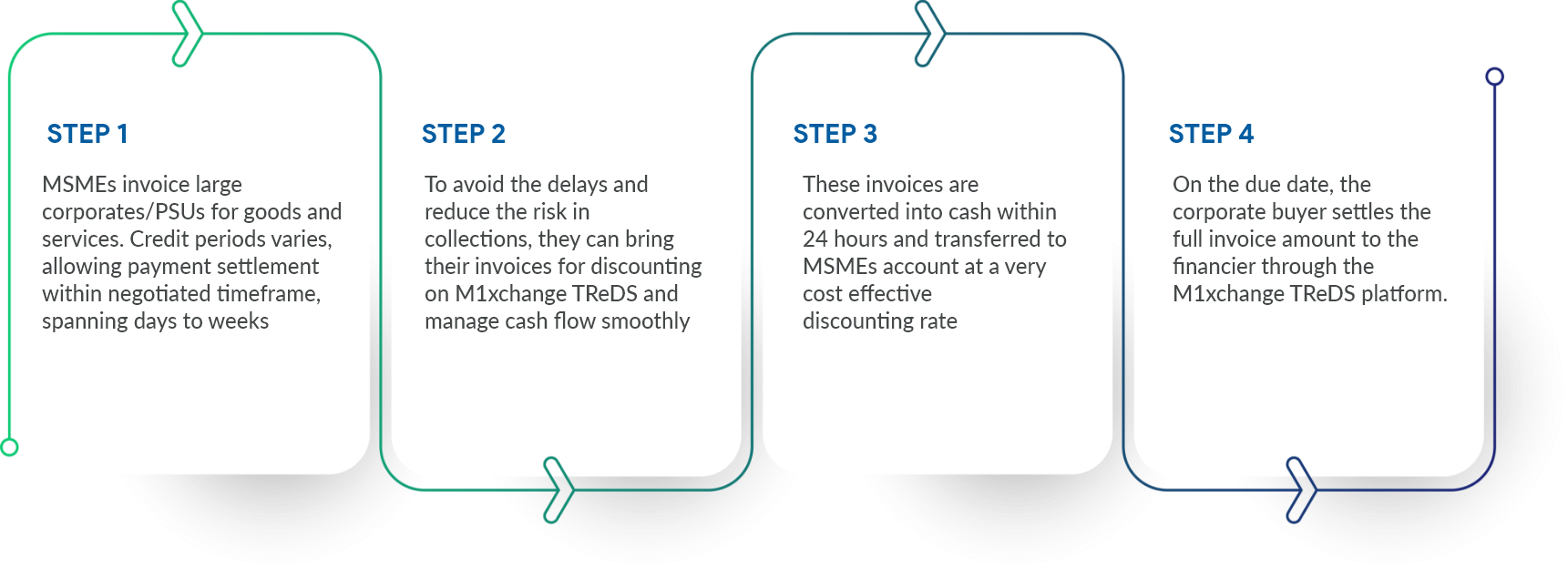

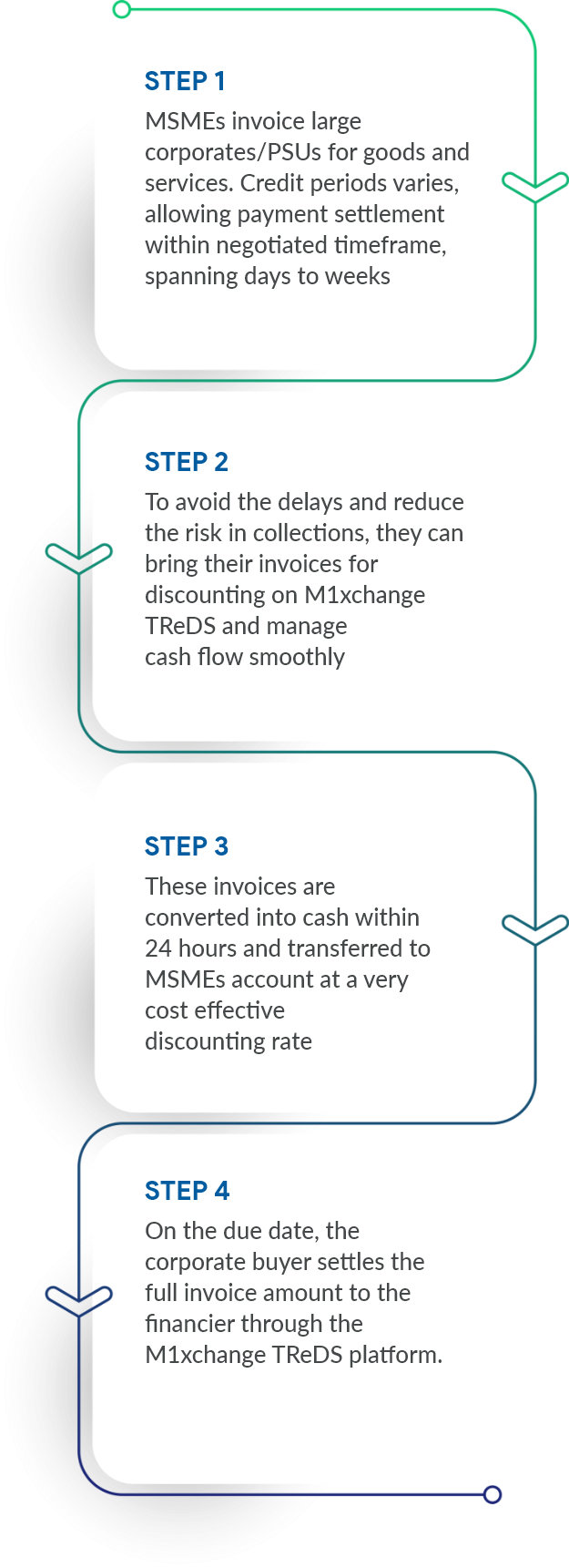

Bill discounting is a financial solution where businesses sell their trade receivables to a financier at a discount to access immediate cash flow. On TReDS platforms in India, such as M1xchange TReDS, this process is digital and seamless. After completing their TReDS registration online, MSMEs can log in to the TReDS portal using their TReDS login to upload invoices. Once corporate buyers approve these invoices, financiers on the TReDS platform bid to offer competitive discounting rates. MSMEs receive upfront payment for their invoices, while buyers settle the amount with the financier on the due date. This process helps businesses improve liquidity without adding debt to their balance sheets.

In bill discounting, the business discount the outstanding invoices to gain access to short-term financial assistance and maintain the working capital. This process is also called “Invoice Discounting”. This process is governed by the negotiable instrument act, 2010. Factoring & Reverse Factoring are two methods a bill is discounted on TReDS platorm. Both the methods are designed to speed up and increase cash flow without disturbing the balance sheet.

Factoring involves a financial transaction where a business sells its accounts receivable (invoices) to a Financier at a discount. The benefits of factoring include working capital optimization, credit protection against bad debts, no collateral required, and prompt payments for your invoices.

On the other hand, reverse factoring (also known as supply chain financing) is a process where a buyer company collaborates with a financial institution (such as a bank or NBFC) to provide early payment to its suppliers. This approach leads to improved cash flow for suppliers, minimizes the need for costly payment requests, secures financing at competitive interest rates, and fosters stronger, long-term relationships between buyers and suppliers.

Bill Discounting by M1xchange is a process guided by RBI to regulate the trade receivables between Corporates, MSMEs and Financiers. Watch the complete video to understand how bill discounting works for all the stakeholders on the TReDS platform.

Discounting bills provide businesses funds upfront rather than waiting for 30-120 days. The completion of multiple business cycles further helps in improved cash flows and increases revenue rather than limiting operations due to a lack of funds.

Bill discounting can be a great way to help manage cash flow and get ahead on bills, but there are some essential features to look out for when choosing a bill discounting service. Here are some of the most important ones:

Businesses being dependent on the cash flow to sustain their business can easily rely on this quick financial aid to access speedy funds and continue to flourish. This process quickens money inflow— profiting the organization in expanding deals, seeking after development, securing hardware, etc.

Bill discounting is a more efficient, faster way of assessing working capital as it is hassle-free and does not involve the lengthy documentation procedure. With M1xchange, businesses can secure financial assistance within 24 hours.

here is no requirement to keep any asset as security as the unpaid invoice is considered as the collateral itself.

Bill discounting helps in saving tax liability. The chances of a company suffering any loss or damage are almost nonexistent when compared to conventional financing frameworks.

Bill discounting service offered by M1xchange does not impact the balance sheet of the business as it is an off-the-book process.

Bill Discounting by M1xchange is a process guided by RBI to regulate the trade receivables between Corporates, MSMEs and Financiers. Watch the complete video to understand how bill discounting works for all the stakeholders on the TReDS platform.

Bill Discounting by M1xchange is a process guided by RBI to regulate the trade receivables between Corporates, MSMEs and Financiers. Watch the complete video to understand how bill discounting works for all the stakeholders on the TReDS platform.

Bill Discounting by M1xchange is a process guided by RBI to regulate the trade receivables between Corporates, MSMEs and Financiers. Watch the complete video to understand how bill discounting works for all the stakeholders on the TReDS platform.

Bill Discounting by M1xchange is a process guided by RBI to regulate the trade receivables between Corporates, MSMEs and Financiers. Watch the complete video to understand how bill discounting works for all the stakeholders on the TReDS platform.

Bill Discounting is a process where a supplier sells an invoice, raised against a buyer to a financier before the due date to access early payment. On the TReDS Platform, like M1xchange invoice is uploaded digitally and once the buyer accepts the invoice, financiers then bid to discount the invoice, and the supplier receives funds immediately at a discounted rate. The financier later collects the full invoice amount from the buyer on the due date.

Bill Discounting on M1xchange streamlines this process using a secure, transparent digital platform regulated by RBI, making it highly efficient for MSMEs and large corporates.

Bill Discounting helps businesses unlock working capital tied up in receivables. Through the M1xchange TReDS Platform, Bill Discounting enables MSMEs to access instant liquidity without collateral. It reduces dependency on traditional credit, shortens the cash cycle, and supports steady operations. For buyers, it improves supply chain reliability and vendor satisfaction.

The digital nature of M1xchange’s TReDS platform also ensures faster processing, competitive financing rates, and complete transparency for all participants in the transaction.

Bill Discounting on the TReDS Platform is designed for MSME suppliers, large corporate buyers, PSUs, and government departments. Suppliers use it to receive early payments, buyers gain extended credit periods, and financiers earn interest from discounted invoices.

Bill Discounting on M1xchange caters to all these stakeholders by providing a secure, paperless ecosystem for invoice financing. MSMEs benefit from collateral-free funding, while buyers and financiers engage in structured, RBI-regulated transactions. Whether you're a growing business or a large corporation, TReDS offers a reliable solution for managing cash flow efficiently.

TReDS is a digital marketplace set up by RBI in order to facilitate the discounting of invoices for MSMEs from corporate buyers through multiple financiers. There are several platforms for bill discounting platforms. M1xchange is one of the leading invoice discounting platforms in India.

Yes, it is eligible for tax benefits as it does not deduct tax at source.

In bill purchasing the whole amount is credited to the individual’s account by the finance institute after the purchase, the seller receives the whole amount of the bill as opposed to invoice/bill discounting, and the bank gets the commission.

Factoring & Reverse Factoring and two methods a bill is discounted on the TReDS platform. Both methods are designed to speed up and increase cash flow without disturbing the balance sheet.

Yes, bill discounting is an excellent option for your business as long as you exercise strong credit control procedures and maintain low debts.

Bill Discounting isn't technically a loan. It's a financing option where you sell outstanding invoices to a financial institution at a discounted rate to receive immediate funds. You don't repay the amount, but instead, repay the invoice value when your customer settles it.

Get in touch to discover the benefits of M1xchange.

Copyright © 2024 Mynd Solutions Pvt. Ltd. All Rights Reserved.