The Trade Receivables Discounting System (TReDS) proposed by the RBI is expected to provide much-needed liquidity to micro, small and medium enterprises (MSMEs). Lack of adequate working capital has been a major issue for MSMEs. Institutional lenders are typically obsessed with immovable collateral and credit history, which these units lack. On the other hand, the large and medium-sized corporates that these units supply tend to delay payments, often inordinately.

CRISIL’s analysis of about 10,000 MSMEs shows their average trade receivable position at about 75 days, which impedes their working capital cycle and crimps growth. One reason for this is that factoring hasn’t taken off in India, given inefficient recovery mechanism, fraud and excessive documentation involved.

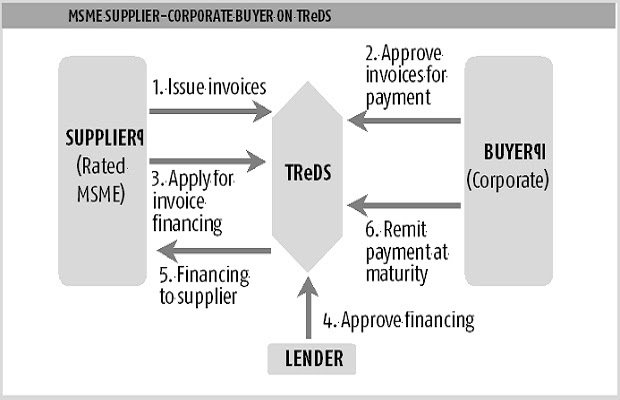

TReDS aims to provide instant liquidity through a transparent and competitive bidding system, initially to MSMEs supplying to large corporates. These MSMEs can discount their supply bills on TReDS with no recourse to them, and large corporates will have to make payments to the lenders who discount the MSMEs’ purchase order bill. This way, the buyer’s credibility will enable MSMEs to obtain cost-efficient and collateral-free finance. The assumption, of course, is that large corporate buyers would be comfortable on ‘without recourse’, which is an untested hypothesis.

RBI has granted in-principle sanction for TReDS to Axis Bank, Mynd Solutions and the Receivables Exchange of India Limited, expected to be launched soon. CRISIL believes TReDS can take off, given a strong framework of debt-recovery mechanism, credit insurance and enablement of partial recourse or full recourse models. The current TReDS design should be enhanced to include supply-side financing, which can happen with third-party credit-assessment of MSMEs that gives lenders some comfort for discounting.

Says Manish Jaiswal, Business Head-SME Ratings, CRISIL: “MSMEs in India rely either on overdraft facilities and short-term unsecured loans, or long-term loans against property. Their potential can be unlocked with models of financing that rely on short-term, self-liquidating models. These will become imminent given digitisation of cash flows and GST roll-out next year.”